Heritage

& Focus

We love to invest in awesome technology

Over the years, our fund has marked its evolution through focused investment periods, resulting in a total portfolio of more than 40 companies.

These commitments were made during three pivotal rounds: our initial deployment in 2007 – 2008, followed by significant growth in 2010 – 2011,

and our most recent cohort in 2016 – 2017. We take pride in the vision and ambition of every company listed below.

Heritage & Focus

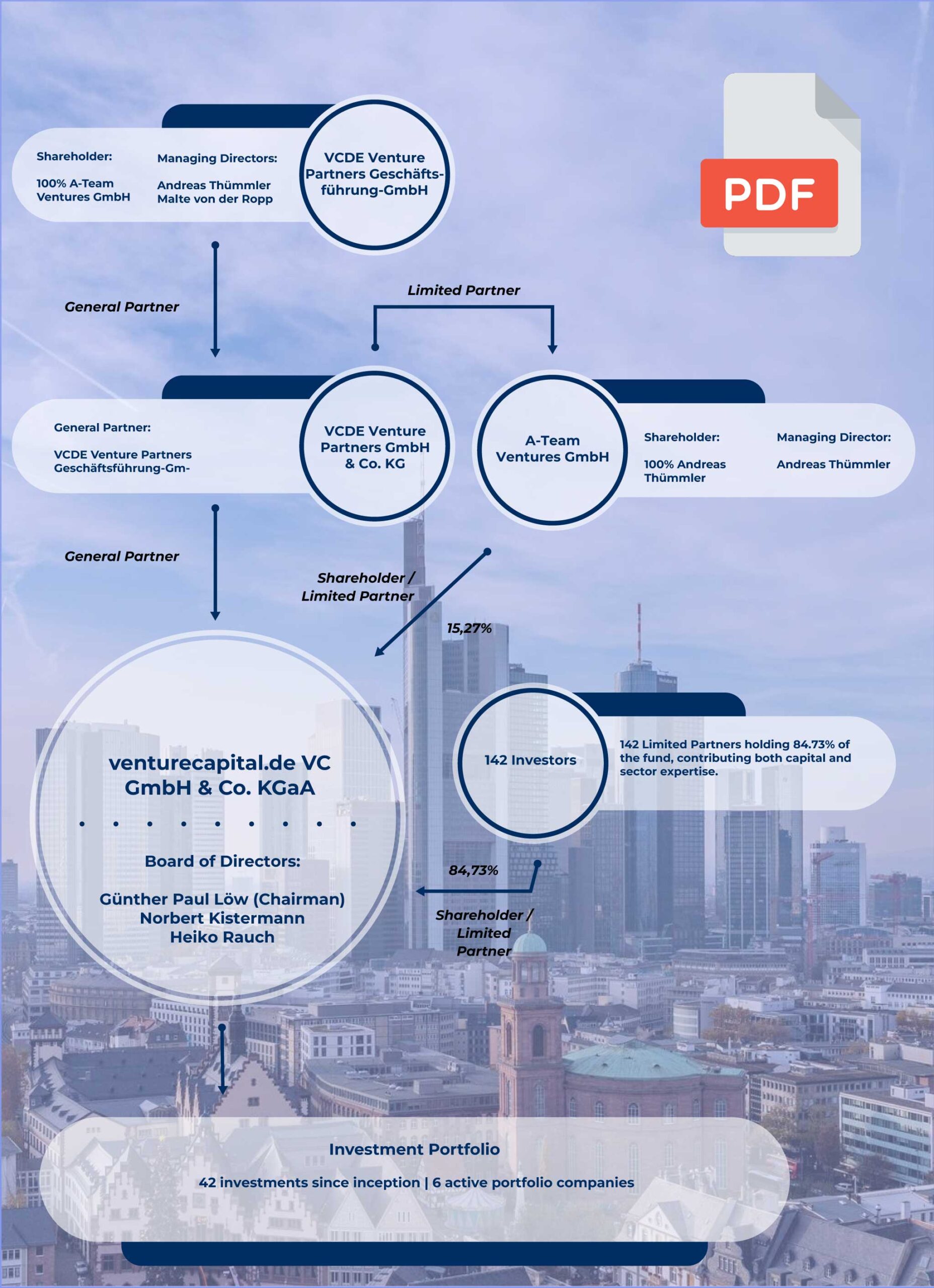

VCDE Venture Partners builds on a strong heritage in corporate finance, originating from the independent M&A advisory activities of the Corporate Finance Partners group, established in the late 1990s. Leveraging this deep experience in transaction execution and strategic growth, we began our principal investment activities with the launch of the venturecapital.de fund in 2008 in Frankfurt. Since then, we have been active investors in technology companies from early‑stage phases through to growth equity rounds. Over the lifespan of our funds, venturecapital.de has invested in more than 40 companies across three investment phases, with a clear focus on software, internet-based business models, telecommunications, and IT services.

As the fund has entered its sundowning phase, we are no longer making new investments and are fully focused on supporting our existing portfolio companies and creating lasting value for our investors. Our team continues to work closely with founders and management, leveraging our network of 140 European entrepreneurs, industry leaders and family offices to drive collaboration and growth within the portfolio.

Andreas Thümmler

Managing Director

Andreas founded Corporate Finance Partners Group (CFP) in Frankfurt in 1998. CFP quickly became a leading European mid-cap tech and internet corporate finance advisory boutique, synonymous with expertise and execution in M&A and growth capital transactions. Under Andreas‘ leadership, CFP completed more than 250 transactions in the Internet, Media, Telecommunications, and Technology sectors.

In 2008, Andreas expanded into fund management and established the venturecapital.de fund. He also launched GrowthCon in Frankfurt, an annual conference attracting tech leaders and investors. Combining business and passion, Andreas founded St. Kilian Distillers in 2012, which has become Germany’s largest whisky distillery and has won multiple gold medals internationally since its single malt whisky launch in 2019.

In 2015, CFP merged with Acxit Capital Management to create ACXIT Capital Partners, now a leading independent M&A advisory firm for German companies, recognized for handling 20–30 cross-border transactions annually. Today, ACXIT is part of the US-based STIFEL Investment Bank, with offices in Frankfurt, Munich, and Zurich.

Malte von der Ropp

Managing Director

Malte started his career at Corporate Finance Partners (CFP) in Frankfurt, ultimately serving as Senior Vice President. In this role, he executed numerous transactions for clients in the Technology, Media, and Telecommunications (TMT) sector. His responsibilities included advising on capital raises, public offerings, trade sales, and takeovers across a dynamic deal landscape.

Expanding on this foundation, Malte now serves as Managing Director at venturecapital.de VC GmbH & Co. KG in Frankfurt am Main. He leads a broad spectrum of technology-focused investments at both early and later-stage levels, shaping the fund’s strategy and portfolio growth within Europe’s technological and digital industries.

Throughout his career, Malte has held supervisory and advisory board roles at companies such as amaysim Australia (IPO 2015, Sydney Stock Exchange), Brille24/Tejado (acquired by EssilorLuxottica), and Turtle Entertainment/ESL (sold to Modern Times Group), helping guide these businesses through landmark exits and market expansion.

Supervisory Board

The supervisory board of the venturecapital.de fund brings together deep expertise from law, banking, and entrepreneurship. The board is chaired by Günther P. Löw, a distinguished lawyer, asset manager, and investment specialist who has held leading supervisory roles at several prominent companies, including Impera Total Return AG, and is managing director of GPL Verwaltungs- und Beteiligungs GmbH in Frankfurt. His career is marked by decades of experience in structuring and overseeing complex investment vehicles, making him a trusted figure in asset management and venture financing.

As deputy chairman, Norbert Kistermann, a seasoned banker, lends his considerable know-how from top executive positions within the German banking sector. He has served as CEO of the Otto M. Schröder Bank, previously led Bankhaus Bauer, and held key management posts at renowned institutions such as BHF-Bank, Dresdner Bank, and Fidor Bank. His extensive background covers strategic development, M&A, and corporate finance, and he is recognized for steering banks and financial institutions through transformative market phases.

Heiko Rauch completes the board as a pioneering entrepreneur and tech investor. Co-founder of zanox.de AG, he helped build Europe’s leading affiliate marketing network, expanding it internationally before achieving a notable exit when the company was acquired by Axel Springer and Publi Groupe. Today, Heiko is active as a business angel, supporting innovative startups and digital ventures across a range of industries, and is known for his commitment to fostering entrepreneurship throughout Europe.

Investment Proposals

The venturecapital.de fund is no longer considering new investments, as our portfolio has entered its final phase. While we are not reviewing new proposals at this time, entrepreneurs may still reach our team via contact@venturecapital.de for general inquiries.

Thank you for your interest in our fund.

Limited Partner Access

This section provides Limited Partners with secure access to all fund reporting and portfolio updates. Key documents -including investor communications, AGM materials, financial statements, and essential fund records- are securely available on the drooms platform.

Please use the link below to log in and access using your individual login credentials.